Business Insurance in and around Seminole

Looking for small business insurance coverage?

No funny business here

Help Protect Your Business With State Farm.

Operating your small business takes commitment, hard work, and excellent insurance. That's why State Farm offers coverage options like errors and omissions liability, extra liability coverage, a surety or fidelity bond, and more!

Looking for small business insurance coverage?

No funny business here

Keep Your Business Secure

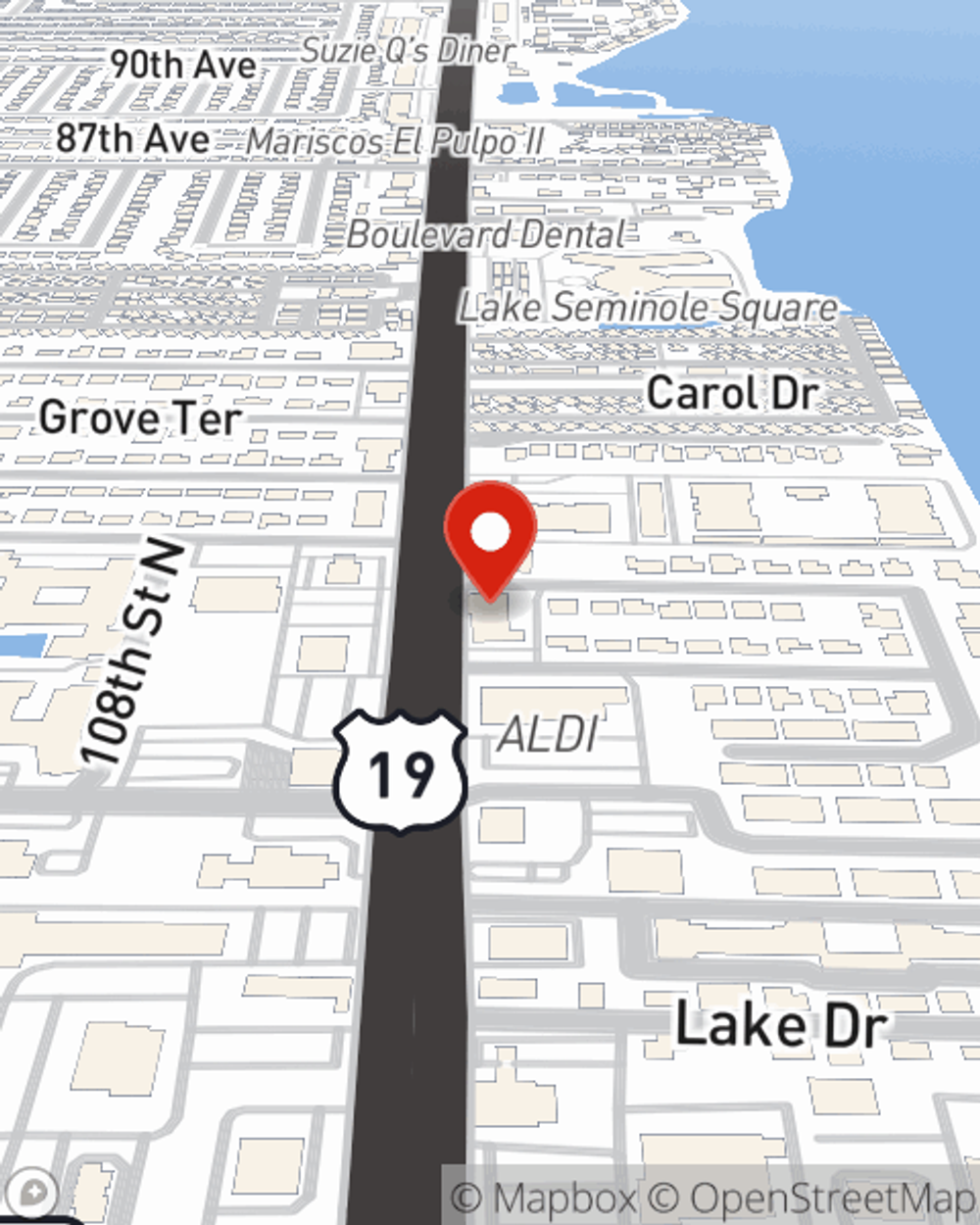

When you've put so much personal interest in a small business like yours, whether it's a HVAC company, a dance school, or a pizza parlor, having the right insurance for you is important. As a business owner, as well, State Farm agent Ben Feller understands and is happy to offer personalized insurance options to fit the needs of you and your business.

Agent Ben Feller is here to discuss your business insurance options with you. Contact Ben Feller today!

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.

Ben Feller

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

How to do small business inventory

How to do small business inventory

Learn more about small business inventory, including types, tracking tools and strategies to help your business succeed.